How I Turned Winter Camp Spending into Smart Investment Gains

You’d never think a winter camp bill could spark a financial breakthrough—but mine did. What started as a stressful expense became a catalyst for smarter money moves. I stopped seeing education costs as pure outflows and began optimizing returns around them. This shift didn’t require risky bets or secret tools—just strategy, timing, and a mindset flip. Here’s how rethinking one seasonal expense opened up smarter ways to grow wealth while staying safe. It wasn’t about cutting corners or sacrificing experiences; it was about working with what we already spend, aligning it with our financial rhythm, and turning predictable costs into opportunities for disciplined growth. The result? Lower stress, better returns on idle funds, and a new sense of control over our family’s financial future.

The Winter Camp Bill That Changed My Financial Mindset

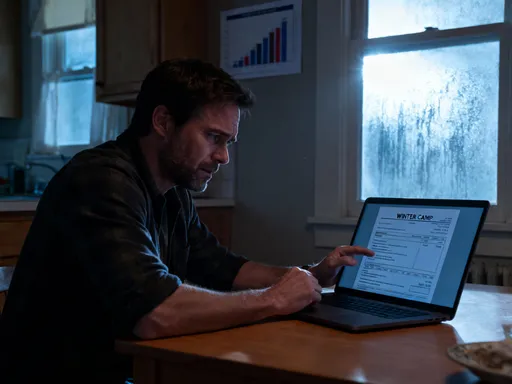

A single invoice for my child’s winter camp arrived in early December—$1,200 due within ten days. At first glance, it felt like a financial punch. We had budgeted for many things, but this large, seasonal expense still landed with weight. It wasn’t unexpected, yet it disrupted our cash flow. For years, we had handled such costs the same way: dip into savings, delay other plans, or quietly use a credit card and pay it off later. But this time, something shifted. Instead of reacting, I paused. Why were we treating this expense as a necessary evil rather than a predictable event we could plan for? That question marked the beginning of a new financial perspective.

I began to reflect on how often families face similar seasonal costs—summer camps, holiday travel, school supplies, extracurricular fees. These aren’t one-time surprises; they recur annually. Yet most of us manage them reactively, treating each as a crisis rather than a cycle. This pattern leads to emotional spending, last-minute borrowing, and missed opportunities to let money work for us. I realized that if we could anticipate these costs, we could also time our savings and investments to meet them—without sacrificing returns or peace of mind.

The key insight was simple: predictable expenses create predictable financial needs. And predictable needs allow for strategic planning. Instead of viewing the winter camp fee as a drain, I began to see it as a fixed point on the calendar—a deadline that could shape smarter financial behavior. This mindset shift didn’t require more income or drastic cuts. It required awareness, planning, and a willingness to treat every dollar with intention. What followed was not a radical overhaul but a series of small, deliberate changes that collectively transformed how we manage money as a family.

From Expense to Opportunity: Rethinking Education Spending

Education-related expenses often carry emotional weight. We want the best for our children, and programs like winter camp offer enrichment, social connection, and safe supervision during school breaks. These benefits are real and valuable. But financially, such costs are also predictable. Unlike emergency car repairs or medical bills, seasonal program fees arrive on a regular schedule. This predictability is a powerful tool—if we choose to use it.

I started by listing all known education-related expenses for the upcoming year. Winter camp, summer camp, music lessons, sports registration, school trips—each had a due date and a cost. I grouped them by season and calculated the total annual outlay. The number was sobering, but also clarifying. Rather than seeing these as scattered, stressful withdrawals, I now saw them as a structured financial obligation, much like property taxes or insurance premiums. This reframing changed everything.

With a full-year view, I could begin to allocate funds gradually. Instead of scrambling in December, I started setting aside money in January. Each month, a portion of our income was directed toward these future costs. But I didn’t stop at saving. I asked: if this money is going to be used in nine months, why should it sit idle in a zero-interest checking account? Why not let it earn something in the meantime? That question led me to explore short-term investment options that aligned with the timing and purpose of each expense.

This approach turned a passive saving habit into an active financial strategy. Every dollar saved for camp wasn’t just being stored—it was working. The expense itself became a planning lever, a fixed point around which I could build a smarter savings and investment rhythm. By treating education spending as part of a larger financial ecosystem, I reduced financial stress and increased efficiency. The cost didn’t go down, but the way we managed it became far more effective.

Timing Is Everything: Aligning Investments with Spending Cycles

One of the most powerful realizations in personal finance is that timing matters as much as the amount saved. I had always believed that investing was for long-term goals—retirement, college, buying a home. But I began to see that even short-term goals, when predictable, could benefit from thoughtful timing. The winter camp payment, due in January, gave me a clear deadline. That deadline became my investment horizon.

Rather than waiting until November or December to start saving, I began setting aside funds as early as April. That gave me a nine-month window to deploy the money wisely. I looked for low-risk instruments with maturities that matched the due date. For example, I used short-term certificates of deposit (CDs) with terms of six to nine months. These offered slightly higher yields than regular savings accounts, with the principal protected and available exactly when needed.

I also explored Treasury bills, which are backed by the U.S. government and considered one of the safest short-term investments. By purchasing a 26-week T-bill in July, I ensured that the funds would mature in late December—just in time for the camp payment. The return wasn’t spectacular—around 4% annually—but it was meaningful compared to 0.01% in a typical checking account. Over $1,200, that difference amounted to nearly $30 in earned interest, with no risk to the principal.

This strategy eliminated the anxiety of last-minute scrambling. More importantly, it turned passive savings into active capital. The money wasn’t just sitting; it was earning. And because the investment duration matched the spending need, there was no temptation to withdraw early or chase higher returns. The discipline of timing removed emotion from the equation and created a repeatable system. I applied the same principle to summer camp funds, starting in January and using similar instruments with appropriate maturities. Over time, this practice became automatic—a financial habit that worked quietly in the background.

Liquidity Without Loss: Building Flexible Yet Profitable Reserves

One common concern with investing for short-term goals is liquidity. Families worry about locking up money they might need. I shared this concern at first. What if an emergency arose? What if the camp was canceled and we needed a refund quickly? These are valid questions, and they highlight the importance of balancing return with access.

My solution was to use instruments that offered both safety and flexibility. For example, instead of putting all the camp money into a long-term CD, I used a laddered approach with shorter maturities. I divided the $1,200 into three $400 portions and invested them in 3-month, 6-month, and 9-month CDs. This way, a portion became available every quarter. If an emergency arose, I wouldn’t have to pay an early withdrawal penalty on the entire amount. At the same time, I still earned more than I would have in a standard savings account.

I also looked into high-yield money market accounts, which offer slightly better returns than traditional checking or savings accounts while maintaining check-writing and transfer capabilities. These accounts are often used by conservative investors who want modest growth without sacrificing access. I found that several online banks offered rates above 4% with no monthly fees and full FDIC insurance. By keeping a portion of our seasonal funds in such accounts, I maintained liquidity while capturing better yields.

The goal wasn’t to maximize returns but to optimize them within a safe framework. I wasn’t chasing 8% or 10% gains—that would have required taking on unnecessary risk. Instead, I focused on earning something rather than nothing, without compromising security or access. This balance was crucial. It allowed me to feel confident that the money would be there when needed, while also knowing it was working for us in the meantime. Over a year, these small gains added up, not just in dollars but in financial confidence.

Risk Control: Why Safety Trumps High Returns Here

When it comes to funding essential family expenses, the primary goal is reliability—not high returns. I made this principle central to my strategy. While it’s tempting to look at stock market gains and wonder if we could earn more, I reminded myself that the purpose of these funds was not to grow wealth aggressively but to cover necessary costs with certainty.

I avoided any investment that carried significant volatility. Stocks, even dividend-paying ones, were off the table. Mutual funds with market exposure were too unpredictable for a nine-month horizon. Cryptocurrencies and speculative assets were never considered. The risk of loss, even if small, was not worth the potential gain. Losing 10% on a $1,200 investment would mean coming up short on the camp payment—and possibly resorting to credit card debt to cover the gap. That outcome would defeat the entire purpose.

Instead, I focused on capital preservation. Every investment I chose was either FDIC-insured or backed by the full faith and credit of the U.S. government. I only used instruments I fully understood, avoiding complex products with hidden fees or unclear risks. This discipline protected me from costly mistakes and emotional decisions. It also aligned with my role as a family financial steward—someone responsible for stability, not speculation.

There’s a difference between being smart with money and being reckless in the name of optimization. True financial wisdom lies in knowing when to take risk and when to avoid it. For short-term, essential goals, safety is the highest priority. By accepting modest but guaranteed returns, I ensured that the money would be there when my child needed it. That peace of mind was worth far more than any extra percentage point of yield.

Practical Tools and Habits That Made a Difference

None of this happened overnight. The real transformation came from building simple, sustainable habits. The first was creating a financial calendar. I used a digital planner to map out all known expenses for the year—camp fees, school trips, birthdays, holidays. Each entry included the amount, due date, and funding source. This visual tool made it easy to see where money needed to go and when.

Next, I set up automated transfers. Every month, on payday, a fixed amount was moved from our checking account into a designated high-yield savings account labeled “Education Fund.” This removed the need for willpower or last-minute decisions. The system worked automatically, ensuring consistent progress toward our goals.

I also used a budgeting app to track our overall spending and monitor the growth of our seasonal funds. These tools provided transparency without complexity. I could see at a glance how much we had saved, how much was earning interest, and how close we were to our targets. This visibility reduced anxiety and reinforced positive behavior.

Over time, these habits became second nature. I no longer dreaded the winter camp invoice. Instead, I looked forward to closing out another planned expense with confidence. The process had become a source of empowerment, not stress. And because it was repeatable, I applied it to other areas—holiday gifts, car maintenance, even home repairs. Each predictable expense became an opportunity to practice disciplined financial planning.

The Bigger Picture: Turning One Win into Lasting Financial Gains

What started as a single experiment—optimizing one winter camp payment—evolved into a broader financial philosophy. I began to see our family’s spending not as a series of leaks, but as a structured flow of money that could be managed with intention. Every predictable outflow became a planning point, a chance to deploy capital wisely and safely.

The financial benefits were real. Over two years, we earned over $150 in interest on funds that would have otherwise sat idle. That may not sound like much, but it was pure gain—money we didn’t have to earn through extra work or cut from elsewhere. More importantly, we avoided credit card debt, reduced financial stress, and built a stronger cushion for unexpected costs.

But the greatest return was not in dollars. It was in confidence. I no longer felt at the mercy of bills. I had a system. I had control. And I had taught my children, by example, that money can be managed with calm, clarity, and purpose. They saw us plan, save, and pay without panic. That lesson is worth more than any interest rate.

Today, our approach to seasonal spending is systematic, stress-free, and slightly profitable. We don’t get rich from it, but we grow wiser. We don’t eliminate costs, but we optimize how we meet them. And in doing so, we’ve built a financial foundation that supports both our present needs and our long-term goals. The winter camp bill didn’t break our budget—it helped us build a better one.